Raising Retirement Age Coming Soon

PORTLAND, USA, Dec 23 (IPS) - Despite the objections, resistance and protests taking place in many countries around the world, raising the official retirement age to receive government provided pension benefits is coming soon.

The primary reason for raising the official retirement age is the rapidly rising costs of national old-age pension programs, which are mainly the result of two powerful global demographic trends: population ageing and increased human longevity.

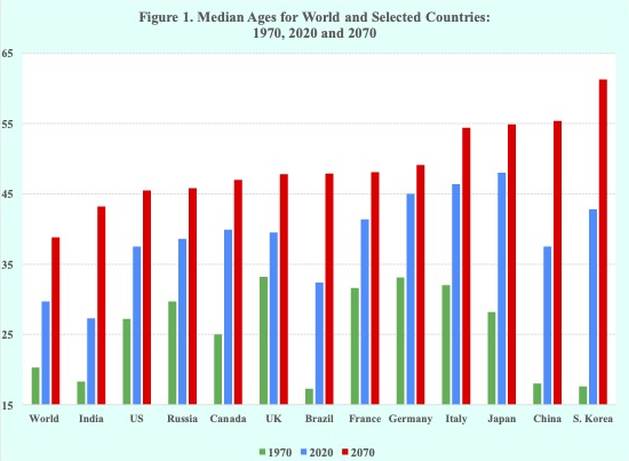

The age structures of populations worldwide are becoming older than ever before. Over the past half century, for example, the median age of the world’s population has increased by 10 years, i.e., from 20 years in 1970 to 30 years in 2020. Many countries have attained median ages in 2020 well above 35 years, such as France at 41 years, South Korea at 43 years, Italy at 46 years and Japan at 48 years (Figure 1).

Moreover, the median ages of populations are expected to continue rising over the coming decades. The median age for the world, for example, is expected to reach close to 40 years by 2070. Also in some countries, including China, Italy, Japan and South Korea, the median ages of their populations by 2070 are projected to be 55 years or older.

The pace of changes in the population age structures of China and South Korea are particularly noteworthy. In 1970 their populations had a median age of 18 years, i.e., half of their populations were children. By 2070 the median ages of China’s and South Korea’s populations are expected to triple to 55 and 61 years, respectively, with the proportion of children declining to 12 and 10 percent, respectively.

Many countries will see their elderly population increase rapidly, reaching about one-third of their total populations by midcentury. In addition, by 2070 the proportion aged 65 years and older in some countries, such as China, Italy, Japan, South Korea and Spain, are expected to be approximately 40 percent.

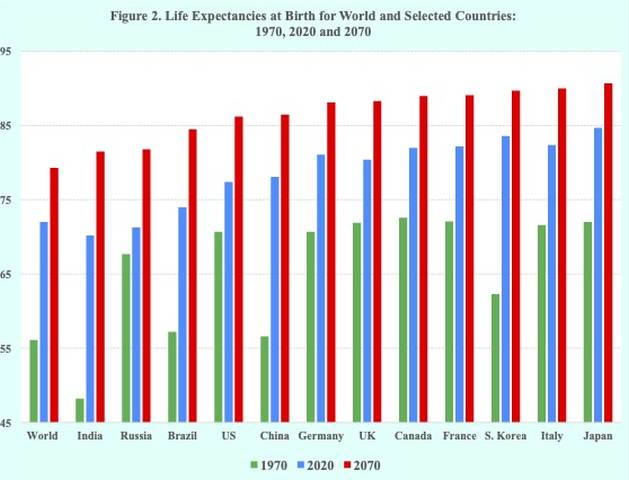

In addition to markedly older population age structures, life expectancies have increased significantly during the recent past with both men and women living longer than ever before. For example, over the past fifty years the world’s life expectancy at birth increased by 16 years, i.e., from 56 in 1970 to 72 in 2020.

The gains in life expectancies at birth for some countries were even more impressive, with increases of more than 20 years during the past five decades. Again, the gains in life expectancy achieved by China and South Korea are particularly noteworthy. China’s life expectancy at birth increased by 21 years, i.e., from 57 years in 1970 to 78 years in 2020, and South Korea’s increased by 22 years, i.e., from about 62 years in 1970 to 84 years in 2020.

Moreover, the life expectancies of the elderly have also increased over the recent past. At age 65, for example, the world’s average life expectancy increased by four years, from 13 years in 1970 to 17 years in 2020. And in many developed countries, including Canada, Italy, France, Germany, Italy and Japan, life expectancies at age 65 years have reached 20 years or more (Figure 2).

Some of the largest gains in life expectancies at age 65 years have been in East Asia. For example, gains in China, South Korea and Japan were 7, 8 and 9 years, respectively, resulting in life expectancies at age 65 of 18, 22 and 23 years, respectively. In other words, people in those countries on average can expect to live to ages 83, 87 and 88 years, respectively.

Despite the recent setbacks in life expectancies due to deaths from the COVID-19 pandemic, life expectancies of the elderly are expected to continue rising throughout the remainder of the 21st century. For example, by 2070 the world is projected to have an average life expectancy at age 65 of 21 years. Also, many developed countries by that time are expected to have life expectancies at age 65 of 25 years or more, i.e., people surviving on average to age 90.

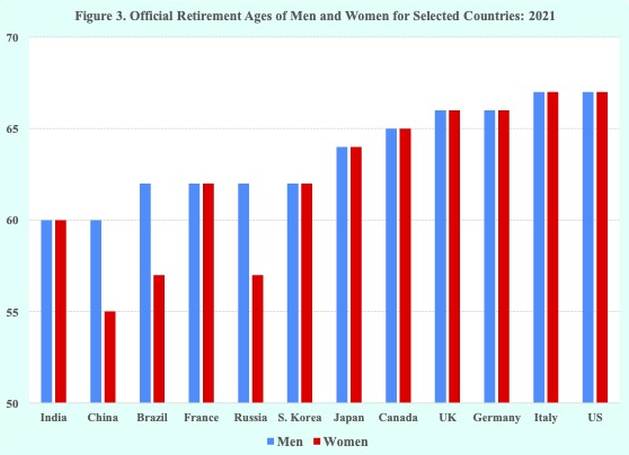

Even with the ageing of populations and increases in human longevity, official retirement ages in order to receive government pension benefits have remained largely unchanged at relatively low levels, typically below 65 years. For example, the official retirement age in France and South Korea is 62 years and in Brazil and Russia the retirement age is also 62 for men, 57 years for women (Figure 3).

However, some countries are now proposing to raise their retirement ages. China, for example, recognizing its rapidly ageing population, shrinking labor force and its national pension’s expected insolvency by 2035, has said that over the next five years it would gradually delay the legal retirement ages, which have been unchanged for more than 70 years.

Despite public objections in the past, China took an initial step several months ago to raise its current retirement age, which is 60 for men and 55 for white-collar women workers and 50 for blue-collar women workers. In one of its eastern provinces people were permitted to start voluntarily applying for delayed retirement.

Also, the French government, remarking “vivre plus longtemps, travailler plus longtemps”, has proposed that beginning in 2023 the minimum retirement age to receive a full pension be gradually increased from today’s 62 to 65 by 2031. Although previous proposals were shelved due to nationwide strikes, the French government has said that without those proposed changes a decrease in the size of pensions would be needed.

One OECD country, the United States, was among the earliest in legislating an increase in the official retirement age to 67 years to receive full benefits, which is above the current average age for OECD countries. Also, seven OECD countries have introduced linkages between life expectancy and retirement age.

In addition to being unpopular among the general public, raising the official retirement age is an issue that governments are not eager to address. Typically, government officials remain silent on the issue and postpone making decisions regarding projected financial shortfalls in national retirement programs.

In the United States, for example, the Social Security Board of Trustees in its 2022 annual report concluded that if no changes are made, the program will not be able to meet its financial responsibilities by 2035. Although various political statements have been made by government officials, the U.S. Congress has yet to propose the needed legislation to address Social Security’s projected insolvency in a dozen years.

In general, the three major options available to governments to address pension insolvency are: reduce benefits, increase taxes and raise retirement age. Reducing benefits, however, would create financial difficulties for many of the elderly. Increasing taxes is also unlikely to be well received by today’s workers and business communities. Consequently, raising the retirement age may be the least objectionable option to address projected pension insolvencies.

The consequences of the demographic realities of older population age structures and increasing longevity are unavoidable. In particular, those consequences include: decreasing numbers in the labor force per retired person: increasing proportions in old age who are living longer; and rising costs for old age retirement benefits that threaten the solvency of the national programs.

In sum, raising the retirement age addresses many of the consequences of those seismic demographic changes as well as expands the size of the labor force, provides additional years for workers to save for retirement, and deals with the projected insolvencies of government pension programs.

Joseph Chamie is a consulting demographer, a former director of the United Nations Population Division and author of numerous publications on population issues, including his recent book, "Births, Deaths, Migrations and Other Important Population Matters."

© Inter Press Service (2022) — All Rights Reserved. Original source: Inter Press Service